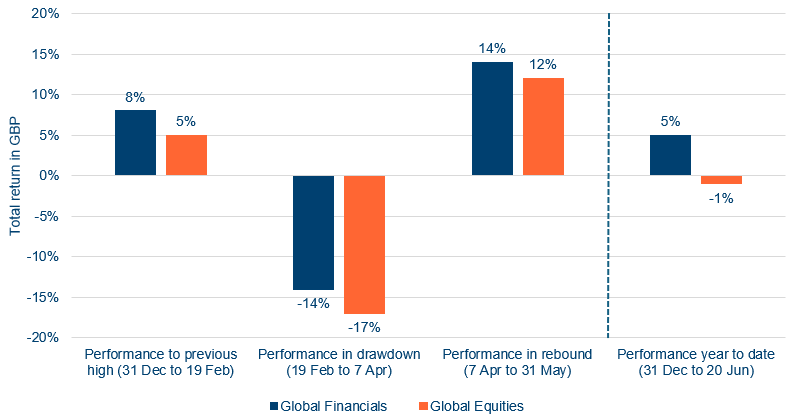

As we hit the halfway mark of a volatile 2025, Financials continue to outperform global equities, despite increased geopolitical risks, ongoing tariff trade disputes and uncertain policy direction from some of the major central banks. The Financials sector has risen 5% in sterling terms so far this year compared with a 1% decline in global equities – and this follows Financials also outperforming global equities in three of the past four years.

| Global Financials versus global equities |

|

| Source: Bloomberg; 20 June 2025 |

We have recently met a number of companies in the sector, including holdings and potential investments, and it is notable that management teams see the sector’s strong fundamentals remaining intact.

We had constructive meetings with several of our holdings at a European Financials conference in Italy last week. Key takeaways included that (1) net interest income1 for European banks remains more resilient than many investors appreciate; (2) capital returns to shareholders remain significant, with European banks expected to return on average 26% of their market capitalisation2, between 2025 and 2027; and (3) asset gatherers and platforms continue to see positive net flows.

Over the longer term, there is further potential upside for European Financials thanks to proposed policy reforms such as the EU Savings and Investments Union which aim to mobilise private savings to finance EU defence and infrastructure spending.

Similarly, the recent Morgan Stanley US Financials conference highlighted that, despite initial worries on the impact of tariffs, asset quality trends consumer and corporate lending remain robust and the momentum towards deregulation is building. On-the-ground feedback from management teams continues to support our positive outlook for the sector.

Positioned for resilience

Since the start of the year, we have taken measures to increase the portfolio’s resilience to volatility. We reduced the Trust’s gearing3 and purchased put options4 on European banks (we have subsequently closed out the put options). We increased our overweight positions in subsectors such as trading platforms and exchanges which benefit from the elevated volatility we continue to see. We are underweight the US given questions around its exceptionalism and overweight Europe and emerging markets such as India, Mexico and Brazil, which have performed well. This has helped deliver attractive relative returns in recent months.

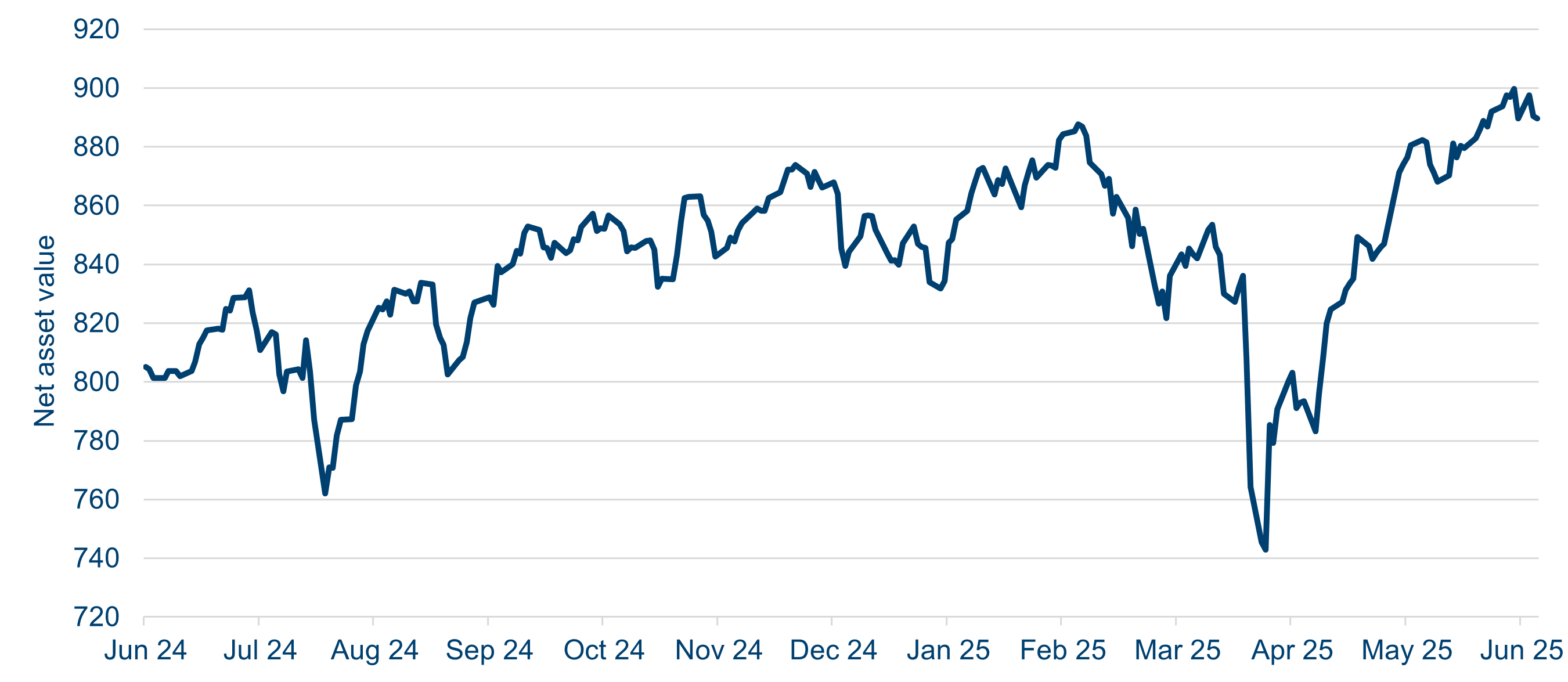

| Equity markets have been resilient Despite recent geopolitical volatility, it is notable that global equities have hit all-time highs. Furthermore, the market reaction to the recent conflict in the Middle East has been measured. |

|

| Source: MSCI All Country World Index (US dollar terms); Bloomberg; 18 June 2025 |

Increased investor interest in Financials

We have met a large number of investors in recent months and interest in the Financials sector is clearly increasing. From these client meetings, we have identified three positives for the sector that we think are underappreciated by the market:

- Positioning is a tailwind: investor positioning remains heavily skewed towards growth sectors and financials are meaningfully under-owned despite the supportive backdrop. It is easy to forget that Financials is the second largest investable equity sector: Global Financials is 18% of the MSCI All Country World Index, behind only Technology at 25%. A change in this relative positioning would be a notable tailwind.

- Interest rate impact misunderstood: concerns that falling interest rates will hurt Financials miss the point. We are transitioning to a world of interest rates at a more normal level of 2-4%, a significant improvement compared to zero/negative rates that defined the post-global financial crisis era, but to our mind valuations do not reflect this optimistic shift in the underlying environment. The steepening of yield curves is also constructive. Additionally, the sector is more diverse than is often appreciated. For example, banks are only 42% of the MSCI ACWI Financials Index which gives us the flexibility to allocate to areas that benefit from lower interest rates. The improved operating environment has led to rising returns on equity but not yet adequately improved valuation multiples.

- Deregulation could surprise to the upside: Regulation appears to be turning from a headwind to a tailwind, first in the US and potentially more broadly. Michelle Bowman’s recent confirmation as Vice Chair for Supervision at the Federal Reserve marks an important shift. In her opening speech, Taking A Fresh Look at Supervision and Regulation, she outlined a more pragmatic approach to regulation. Recent news flow suggests deregulation is already gathering pace, as outlined in a Bloomberg article titled US Plans to Ease Capital Rule Limiting Banks Treasury Trades (18 June). We think this trend is underappreciated and could unlock both earnings growth and multiple expansion5 for the sector.

Positive outlook

Despite the uncertainties, the Financials sector continues to prove its strength, delivering robust performance with healthy fundamentals and compelling long-term potential. Financial companies are benefitting from resilient net interest income, strong capital returns and underappreciated structural tailwinds such as policy reform and the start of deregulation.

The Polar Capital Global Financials Trust is actively managed to take advantage of opportunities as they arise across the subsectors. We strongly believe the outlook for global financials remains positive as we continue to see attractive valuations and the potential for the sector to rerate.

1. Net interest income (NII) is the difference between revenues generated by a bank's interest-paying assets and the cost of paying out interest

2. The total value of a company's shares in the stock market

3. The relationship of a company's debt to its equity, measuring how much a company is financially leveraged

4. A put option grants the right to the owner to sell some/all of an underlying security at a specified price, on or before the option's expiration date

5. When a company's share price rises not because profits have gone up, but because investors are feeling more confident; often a sign that sentiment is improving or the outlook for a sector - such as Financials - is becoming more positive.